Cashback credit cards are powerful ways to boost revenue and growth. This is because they offer tangible benefits like discounted shopping and fantastic savings to consumers. This is a lucrative addition to anyone’s wallet thus fueling sales and ensuring loyalty and repeat business. Plus, businesses save huge funds that are otherwise spent on marketing and advertising their company to their customers.

The credit card market size is forecasted to reach a whopping $1057.48 billion in 2031. Besides fraud protection and accessibility, the cashback credit card model is a significant driver of this growth.

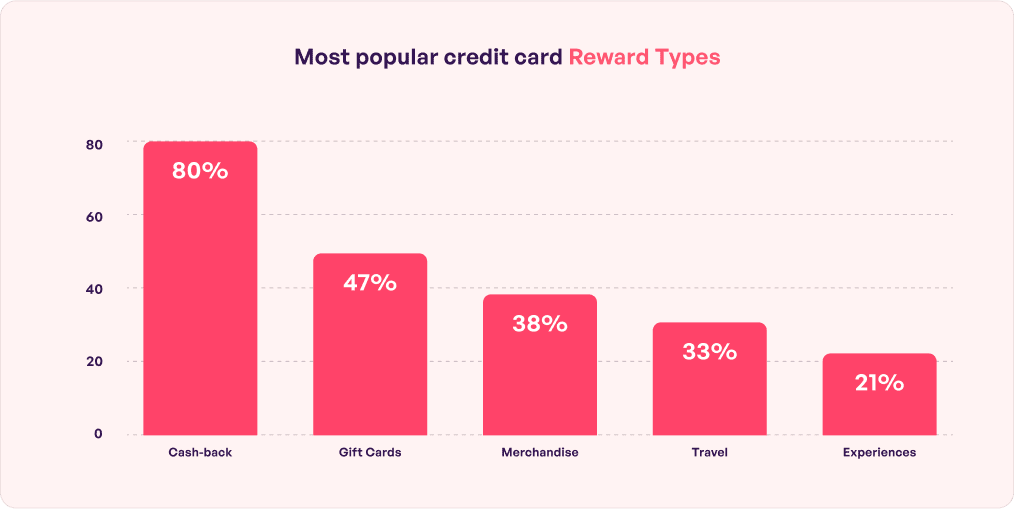

The December survey of 2,764 U.S. adults collaborating with the 2022 Bankrate Awards found that 41% of cardholders said cashback is their most loved credit card feature. In fact, it has surpassed all other features among American consumers across all generations. So much so that cardholders often tend to pick cashback over low interest.

The December survey of 2,764 U.S. adults collaborating with the 2022 Bankrate Awards found that 41% of cardholders said cashback is their most loved credit card feature. In fact, it has surpassed all other features among American consumers across all generations. So much so that cardholders often tend to pick cashback over low interest.

But how do cashback credit cards draw customers? Well, a certain percentage, say 2-5% of the cardholder’s eligible purchase, gets refunded. This offering helps lower churn rates while drawing in new business. The objective here for businesses is to entice consumers to use cards instead of cash or other alternatives. But why is cashback gaining popularity? Let us learn the customer psychology which companies profit from.

Table of contents

The psychology behind cashback credit cards

Getting attracted to rewards is a natural consumer behavior. The cashback credit card capitalizes on this psychology. You also create a positive brand impression since there is an instant sense of gratification among buyers. They tend to feel that they are being rewarded for their loyalty which motivates them to come back to your business next time as well.

Cashback further reinforces a few standard actions like better brand interactions, positive purchase decisions, and habitual buying. However, just offering cashback might not help. Consumers consider several other factors like the brand’s social media presence and previous buying experience. Further, you must also manage the cashback requests well. It is instrumental to work on the bigger picture as well to make sure your cashback credit card is altogether successful.

Cashback further reinforces a few standard actions like better brand interactions, positive purchase decisions, and habitual buying. However, just offering cashback might not help. Consumers consider several other factors like the brand’s social media presence and previous buying experience. Further, you must also manage the cashback requests well. It is instrumental to work on the bigger picture as well to make sure your cashback credit card is altogether successful.

For instance, Robinhood Gold Card, Well Fargo Active Cash, Blue Preferred Card, and Chase Freedom Flex have been turning heads with their amazing cashback feature. But these brands also have strong online platforms to showcase their products and services. They strive to offer a positive user experience to ensurḍe the competitive edge.

What is Robinhood Gold Card: everything you need to know

Robinhood Markets, Inc. is an American financial services company in California. Their cash back credit card, issued by Coastal Community Bank, is designed for smart spending for all. However, the cash back feature is exclusively available to Robinhood gold members. Let us dive into the basic features of their cashback business model.

- Offers 3% cashback on all categories.

- A 5% is cashback available when customers book via the Robinhood travel portal.

- No annual or foreign transaction fee is applicable.

- Available exclusively for Robinhood Gold members.

Now, let us understand what are the benefits of the Robinhood Gold Card:

- Protection from trip interruptions.

- High-end purchase security.

- Auto rental collision damage waiver.

- Extended warranty protection.

- Roadside dispatch.

- Zero liability protection.

- Visa Signature concierge service.

- Travel and emergency assistance.

- Return protection.

One of the most interesting benefits of the Robinhood Gold Card is that customers can take control of their purchases with disposable virtual cards. It has a one-time usage facility with freshly generated card numbers, expiry dates, and CVVs. Once the transaction with the Robinhood Gold Card is done, the details expire. It ensures more efficient, private, and secure spending. Further, virtual cards save time since the process is done with just a few clicks.

The Robinhood Gold Card earns not just based on a purchase. Consumers can earn points from promotional offers too. The points can also be converted into cash and sent to the Robinhood Financial Brokerage Account as per the conversion rate.

The Robinhood Gold Card earns not just based on a purchase. Consumers can earn points from promotional offers too. The points can also be converted into cash and sent to the Robinhood Financial Brokerage Account as per the conversion rate.

A few transactions, however, are not considered to be eligible for cashback in the Robinhood business model. This includes:

- Cash advances

- Balance transfers

- Items returned for credit

- Foreign currency purchases

- Money orders

- Buying gaming chips or lottery tickets

- Business-type transactions, and

- Unauthorized shopping.

The good news is that a notice of 45 days is provided in case the cash back program is canceled. If the program is terminated, cardholders still have 90 days to redeem points. The same timeframe is available if customers choose to close their accounts.

Wondering what Robinhood Gold offers? Here’s a list:

- Easy accessibility of cashback with the Robinhood Credit Card app

- Cardholders of any age are allowed to help everyone build credit

- Tracking family spending and setting upper limits

- Locking lost cards for advanced security.

As an entrepreneur, you can build something similar to Robinhood Gold Card. This business model is extremely profitable and viable to fulfill client needs and stay in the forefront of their mind. As a result, it helps in bringing impressive ROI to your business. Here’s how to get started in simple steps:

Step 1: Use online monitoring tools to know the result of your cashback policy. This can be done even before you launch the program. It will help you tweak the terms and conditions accordingly to align with your goals.

Step 2: Weigh your company’s assets and liabilities. It helps to set the right cashback rate. However, try not to exceed 10%. Else, you might end up cutting down your profit.

Step 3: Strategically create a draft of an effective cash back policy.

Step 4: Talk to a trusted app development company to give it a final shape.

Enter Simublade. We are a Texas-born company offering end-to-end financial app development services to build a similar cashback credit card model. Getting an insight into the expectations, core elements, and functionalities will help us ideate, design, and develop the same. You get software that is worthy, compliant, and most importantly, secure. We incorporate next-gen technologies like AI and have the technical skills to build innovative products that are Gen-Z-approved.

Where to offer cashback?

Cashback is not free money. It is a way to offer rewards to your customers for making purchases. This is simply a portion of the merchant fees that you receive from retailers against every swipe.

In general, you can make it available across multiple categories like:

- OTT platforms

- Online retail purchases

- Gas stations and grocery shops

- Movie or travel tickets

- Utility bill payments

- Cafes and restaurants

- Hotels, airlines, and airport lounges

- Clothing and jewelry.

Further, offer cashback to customers in the following situation:

- Referring a friend to purchase from your brand.

- Completing a purchase instead of cart abandonment.

- Participating in surveys and promotions.

- Purchasing bundled products, say, a sun-screen kit.

- Upgrading services to highly-priced products and services.

- Winning social media content.

We at Simublade are a team of highly skilled and dedicated engineers and strategists. We can help add a cashback program – whether in an established app or a complete mobile payment app development from scratch. Our professionals know the inside-out of technologies – enough to help you catch the attention of potential and existing customers. We helped an USA retail company integrate a cashback driven model. It helped them see better revenue and 3X higher transaction volumes.

How to make your cashback policy attractive and successful?

A study by a leading e-commerce platform Yopto found that 30% of consumers are most likely to purchase if a cashback is offered. Wondering how to make your cashback credit card unique? Go ahead and follow these tips:

- Start with a welcome bonus. It can be rewarded once the consumer meets a particular spending threshold.

- Pair it with a loyalty program to offer a more meaningful experience. Consider extensive data collection for personalization to see a positive ROI.

- Take a step back to understand whether you want to reward in rupees or points. For instance, cashbacks in rupees are ideal for customers who are into flexible spending. This way it is not narrowed down to verticals like travel or a fitness membership. The money can be used for all categories at any time. Fixing rewards, on the other hand, becomes vendor-specific. Customers might also have to shop around during a fixed time or wait for the best deal to receive the points.

- Keep the program simple, which means making sure your customers do not have to jump through hoops to get their cashback. Cashback is typically straightforward and you can automate them in the app.

At Simublade, we understand your business and work with a common goal: to make it a success. So, we focus on several factors while building a fintech app – collaboration and innovation with a pursuit of excellence. Our team is compliant-focused with a proven track record of powerful applications with guaranteed security. Now that you understand what a cashback model is, get in touch with us to start working on your future-ready solution.

FAQs

Q. How does cash back benefit credit card companies?

Ans. Cash back is a way to reward customers. This encourages them to use the credit card more frequently in most or all categories which ultimately benefits the company.

Q. Who pays for credit card rewards?

Ans. Both the merchant (interchange fee) and the customer (higher price) indirectly pay for their cashback reward.

Q. What is a good cash back percentage?

Ans. Both a 2% cash back and 1.5% cash back + bonus can be a powerful magnet. You can retain old customers and attract a new group simultaneously. This is a win-win situation since they maximize savings while you beat your competitors.

Q. Where to offer higher cash backs?

Ans. A 2024 Pew Research found that 76% of Americans have international travel experience. In general, they enjoy 2-3 trips per year. So, you can consider a cash back of upo 5% in the travel category to draw more customers into your business.